Margin Markup Calculator: What You Need To Know

Updated: 30.10.2023.

Markup vs margin: they’re not the same. You may think I’m stating the obvious here, however, there often seems to be some confusion about what they both are.

Businesses can make the mistake of using markup to calculate their selling price, and making the assumption that their markup is also their gross profit margin. This is not correct.

For recruitment businesses, it’s important to have a clear understanding of both margin markup calculators. A lot of effort goes into placing a candidate, so it’s vital to make sure you are calculating your profit correctly. Knowing how to apply markup and margin to your recruitment business can also increase your bottom line.

To help you out, we’ve pulled together this comparison guide and shared the winning formulas on how to calculate both.

Markup Vs Margin: What are They?

Before we can go into the nitty-gritty of how to calculate your markup and your margin, we need to clarify exactly what they both are and how they are different.

To make sure you keep an eye on your business’s bottom line, try our margin and markup calculator.

Margin Markup CalculatorWhat is Margin?

Your margin is the difference between your selling price and the money you have to spend to create your product. The margin is worked out as a percentage of your selling price formula.

With regards to recruitment, the money you have to spend might include any of the following:

- Costs to advertise the role

- Your employee’s salaries

- Phone bills

- Travel costs to visit the client

- Subsistence expenses for client meetings

What is Markup?

Your markup is when you create a product for one cost and then sell it for a higher price. Marking up your products means you are able to earn profit on your products. Your markup is the difference in cost between your selling price and the amount you spent to make your product.

Markup percentage calculator is useful as you can be certain that your recruitment business is creating a proportional amount of money for each of your products, regardless of whether your costs go up or down. As your business grows, your markups will scale in proportion.

How are They Different?

Margin vs markup: These are two different perspectives on the relationship between price and cost (much like a cup being half full or half empty).

As previously mentioned, the marginal profit calculator lets you know the difference between your selling cost and the amount you spent to make the product, and markup is the difference between your selling price and your profit.

There are benefits to both:

- Markup ensures that you are generating revenue every time you make a sale.

- Margin helps you to track how much profit you make for each sale.

- Markup is good when you’re getting started as it helps you fully understand the money coming in and out of your business.

- Margin clearly highlights the impact your sales have on your bottom line, as it is a reliable and accurate way of calculating the difference between your price and your cost.

Click here to read more about the maths behind markup and margin.

How to Calculate Your Markup and Your Margin

Before you can calculate your margin and markup percentage, you need to get to grips with these terms:

Price/Revenue:

Your earnings before deducting costs

Cost/COGS:

Costs to create sales items

Gross Profit:

Your revenue, minus your COGS

How to calculate Markup

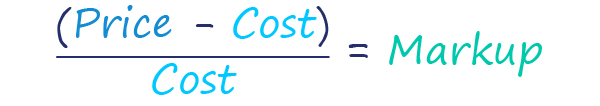

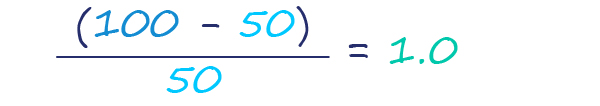

You can calculate your markup using this formula:

1. Find your gross profit

To work this out you have to minus your cost from your price

2. Divide your gross profit by your cost

You’ll then have your markup. To turn it into a percentage, simply multiply it by 100 and that’s your markup %.

Here’s a simple example of how the calculation of markup percentage formula works:

So, when you multiply 1 by 100, you get a percentage of 100%.

Calculating Your Margin

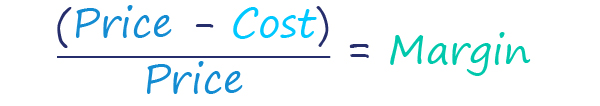

To calculate your margin, use this formula:

1. Find your gross profit

Again, to do this you minus your cost from your price.

2. Divide your gross profit by your price

You’ll then have your margin. Again, to turn it into a percentage, simply multiply it by 100 and that’s your margin %.

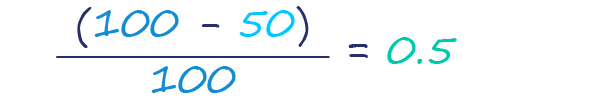

Here’s an example of how your margin formula looks in action:

And when you multiply 0.5 by 100, you get a margin percentage of 50%.

To make sure you keep an eye on your business’s bottom line, try our margin and markup calculator.

Calculating Markup and Margin for a Placement

As a recruitment consultant, you’ll typically follow business guidelines for what margin you can work at.

The example below shows the process to calculate markup and margin.

You’re placing a candidate at £325 per day and are working at 20%. To work out the client’s charge rate to meet your 20% margin target divide £325 by 80 and then times (x) by 100.

325/80*100 = £406.25.

- Client charge rate = £406.25

- Candidate pay rate = £325

Markup and margin can then be calculated easily:

- £406.25 – £325 = £81.25 (this is the gross profit you’ll make per day for the duration of the placement)

- £81.25/£325= 25% markup

- £81.25/£406.25 = 20% margin

In other words:

- Markup = gross profit divided by pay rate (£81.25/£325 * 100 = 25%)

- Margin = gross profit divided by charge rate (£81.25/£406.25 *100 = 20%)

So, for this placement, your markup is 25% and your margin is at the 20% you needed it to be.

Getting to grips with margin vs mark up in relation to your business is vital. Do the maths wrong and you may end up out of pocket without realising it. Get it right, and you’ll improve your profit and grow your recruitment business.

Frequently Asked Questions

What’s the difference between margin percentage and markup percentage?

The margin percentage represents the portion of the selling price that is profit, while the markup percentage is how much the cost of goods sold has been increased to determine the selling price.

How do I calculate the markup from the cost of goods sold?

To determine the markup, subtract the cost of goods sold from the selling price. Then, divide the result by the cost of goods sold and multiply by 100. This gives you the markup percentage. The markup formula is: [(Selling Price – Cost of Goods Sold) / Cost of Goods Sold] x 100.

How is the 20 markup different from other percentages?

A 20 markup means that the cost of goods or services sold or costs of production have been increased by 20% to determine the selling price. For instance, if the cost is £100, with a 20 markup, the selling price would be £120. Typically, recruiters do not have costs of production. Please see the questions below related to specific costs that recruitment businesses may incur.

What is a net profit margin and how is it different from gross profit?

The net profit margin is the percentage of profit a company earns from its total revenue after all expenses, taxes, and costs have been deducted. Gross profit, on the other hand, is the profit made after deducting only the cost of goods sold, not taking into account other operational expenses.

What’s the purpose of a margin calculator and profit margin calculator?

A margin calculator is used to determine the margin percentage from the selling price and cost of goods sold. The profit margin calculator, on the other hand, is used to figure out the percentage of profit in relation to the total revenue.

Why is it important to enter the cost accurately in price costing?

Entering the cost accurately is crucial as it directly affects the selling price, profit margin, and markup percentage. Inaccurate data can lead to mispricing, which might result in reduced profits or overpricing that might deter potential clients.

How do national insurance and tax year affect my profit margins?

For a limited company or an umbrella company, national insurance contributions and taxes are part of the company’s operational expenses. These costs should be accounted for when calculating net profit margin. The tax year determines when these expenses are to be filed and paid, affecting cash flow and potentially impacting profit margins for that period.

Are there any tools like a tax calculator to help with financial calculations?

Yes, many online tools, such as tax calculators and margin calculators, can help recruitment businesses with financial calculations. These tools can assist in accurately determining the amount owed in taxes for a given tax year or help calculate profit margins to set competitive prices.

When should a recruitment business consider shifting from being a limited company to an umbrella company (or vice versa)?

This decision largely depends on the company’s financial situation, administrative preferences, and strategic goals. While a limited company offers more control over financial management, an umbrella company might simplify matters related to national insurance and taxation.

How do I determine the right selling price for my services?

Start with the costs of services sold. Apply the desired markup formula or percentage to get a provisional selling price. Factor in competitive market prices, client expectations, and your desired profit margin. Adjust accordingly to find a price that meets business objectives and market demands.

What are the typical costs for a recruiter when placing a permanent employee?

1. Advertising expenses

The costs associated with posting job ads on job boards, social media platforms, or in traditional media outlets.

2. Job board subscriptions

Many premium job boards require subscription fees to access their databases and post job openings.

3. Candidate assessment tools

Investments in tools or platforms that help assess a candidate’s skills, personality, and suitability for a role, such as psychometric testing.

4. Background checks

Costs associated with verifying a candidate’s employment history, criminal record, education, and sometimes even credit checks.

5. Interview expenses

If candidates are from distant locations, there may be costs involved in reimbursing their travel or providing virtual interview platforms.

6. Recruitment software and tools

Investing in recruitment software to manage the hiring process efficiently, from candidate tracking systems to communication tools.

7. Salary and commission

The base salary of in-house recruiters and the commission for placements, especially in agencies.

8. Training and development

Occasional training sessions for recruiters to stay updated with the latest industry trends, technologies, or best practices.

9. Administration costs

General overheads including phone bills, office space, stationery, and other utilities.

10. Events and networking

Attending job fairs, hosting recruitment events, or participating in networking sessions to build a talent pool.

What are the typical costs for a recruiter when placing a contractor?

1. Contractor payroll management

Managing payments, invoicing, and ensuring that contract workers are paid on time.

2. Compliance and legislation

Ensuring that the contract terms, payment structures, and working conditions adhere to the local employment laws.

3. Insurance costs

Depending on the nature of the job, some recruiters may need to cover liability insurance for contract workers.

4. Contract negotiation fees

Potential costs if legal professionals are involved in drafting or reviewing contract terms.

5. Onboarding and training

While contractors are usually experienced, there might be company-specific onboarding or training sessions required.

6. Ongoing management

The administrative costs associated with managing and communicating with contract workers during their placement.

7. Termination or extension fees

Potential costs when a contract ends, either due to the completion of the term or early termination. Conversely, extending a contract may also involve additional administrative costs.

8. Margin or markup

For agencies, a markup on the hourly or daily rate of the contractor is added to cover their services and make a profit.

9. Umbrella company fees

If contract workers are employed through an umbrella company, there are associated fees to consider.

10. Replacement costs

In the event a contractor doesn’t work out, or leaves before the contract’s end, there may be costs associated with finding a replacement quickly.

It’s essential for recruiters to anticipate these costs, budget accordingly, and ensure they’re covered either through client fees or other revenue streams. Proper planning helps maintain profitability while offering top-notch recruitment services.

What financing costs should a recruiter plan for?

Why should recruiters understand their financing costs:

1. Loan interest payments

If a recruitment agency takes out a business loan or overdraft to cover initial setup or ongoing operational expenses, interest payments on these borrowings are a primary financing cost.

2. Credit card fees and interest

If business credit cards are used to cover expenses, there will be associated interest rates and possibly annual fees to consider.

3. Invoice financing fees

Recruitment agencies might use invoice financing or factoring services to get immediate cash based on their outstanding invoices. These services come with fees.

4. Bank charges

Regular bank charges for business account maintenance, wire transfers, overdrafts, and other banking services.

5. Lease or hire purchase interest

If the recruiter leases office equipment, vehicles, or any other asset, there might be interest costs attached to the lease or hire purchase agreements.

6. Late payment fees

If the recruiter is late in paying any outstanding debts, suppliers, or vendors, they may incur late payment fees.

7. Foregone interest

If funds are tied up in the business rather than being invested elsewhere, there’s a potential opportunity cost. It’s the interest or return those funds might have earned if invested elsewhere.

8. Cost of equity

If a recruiter raises capital by issuing shares in the company, the cost of equity is the return that shareholders expect on their investment. While it’s not a direct out-of-pocket expense, it’s an important cost to consider when weighing financing options.

9. Brokerage or intermediary fees

When using financial intermediaries or brokers to secure financing or manage financial transactions, they might charge fees for their services.

10. Early repayment charges

Some loans or financial agreements come with penalties or charges if you pay them off before the agreed-upon term.

11. Currency conversion costs

If the recruitment agency operates internationally and deals with multiple currencies, there can be costs associated with converting money from one currency to another.

12. Financial advisor or consultant fees

If the recruitment agency seeks the expertise of a financial advisor or consultant to manage or plan its finances, there will be associated fees.

13. Financial software or tools subscription

Using accounting, payroll, or other financial management software might come with subscription or licensing fees.

14. Insurance premiums for financial protection

Insurances like credit insurance, which protects businesses from non-payment of invoices, come with premiums. While this isn’t a direct financing cost, it’s related to financial management and is worth considering.